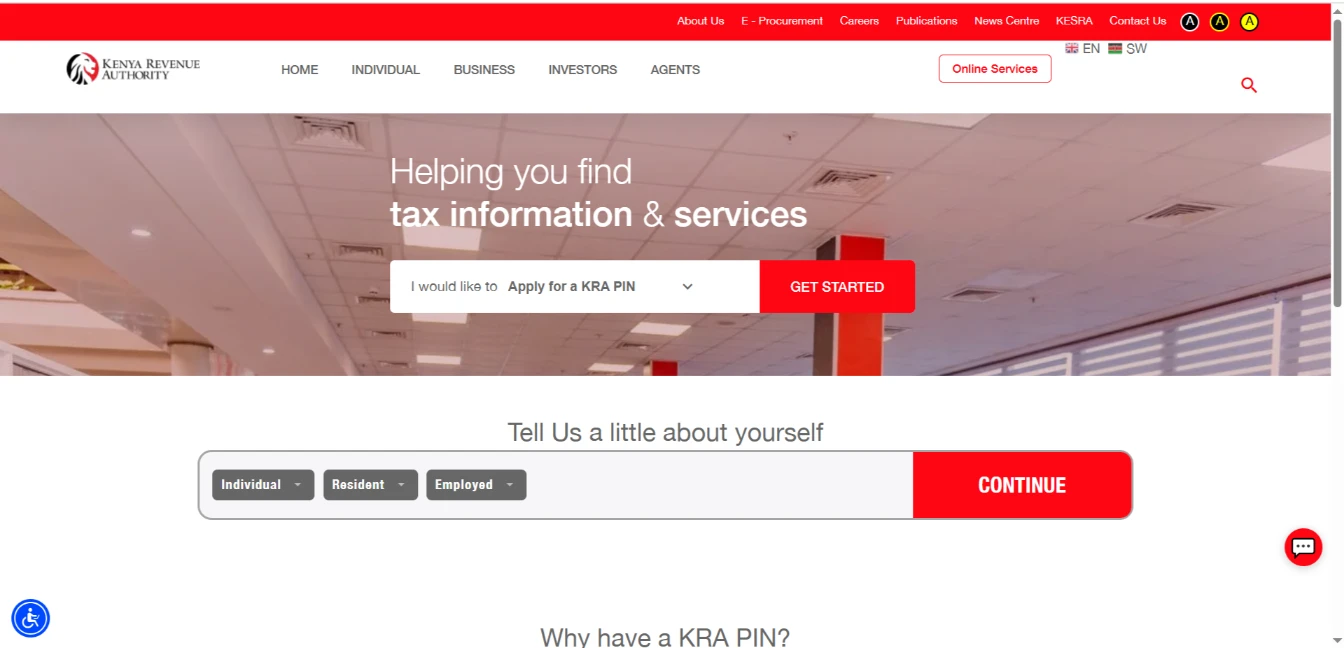

A KRA PIN (Personal Identification Number) is essential for various financial and legal

transactions in Kenya. Here’s a quick guide on who should obtain a KRA PIN and why it

matters.

1. Employed Individuals

If you are employed, having a KRA PIN is crucial. Your employer will require it for tax

purposes, as it is used to withhold and remit your Pay As You Earn (PAYE) tax to the Kenya

Revenue Authority (KRA). This ensures that you are compliant with tax regulations and

helps you avoid penalties.

2. Business Owners

Entrepreneurs and business owners must have a KRA PIN to operate legally. Whether you’re

running a small business or a large enterprise, the PIN is necessary for tax registration, filing

returns, and conducting business transactions. It also instills credibility with clients and

partners.

3. Individuals with Rental Income

If you earn income from rental properties, you are required to have a KRA PIN. This allows

you to declare your rental income and pay the applicable taxes. Failure to do so could lead to

legal issues and hefty fines.

4. Students Applying for HELB Loans

Students seeking financial assistance from the Higher Education Loans Board (HELB) must

provide their KRA PIN. This helps verify their identity and ensures proper loan management.

5. Individuals Performing Specific Transactions

A KRA PIN is necessary for various transactions, including:

• Opening a bank account

• Buying or selling property

• Importing or exporting goods

• Registering a company

• Applying for a driving license

In summary, anyone engaging in employment, business, rental activities, applying for loans,

or performing any significant financial transactions should obtain a KRA PIN. It’s a critical

step toward ensuring compliance with Kenyan tax laws and facilitating smooth financial

operations.

For assistance with obtaining your KRA PIN, feel free to reach out to Seal Associates—we’re

here to help