Hey fellow Nairobian. As we kick off another year of hustling in this vibrant city, let’s talk about something that’s quietly sabotaging too many Kenyan SMEs: sidelining finance until it’s too late.

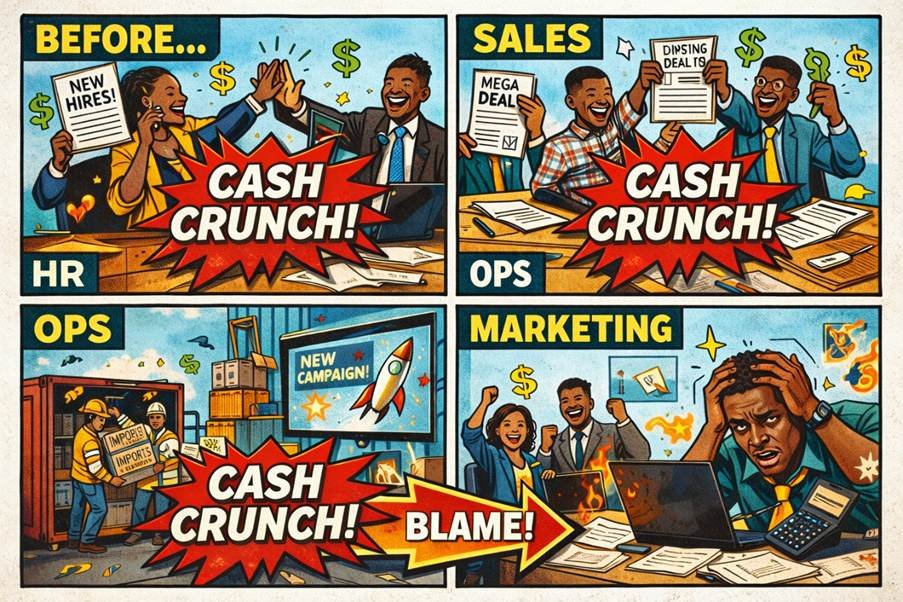

I’ve seen this drama unfold in boardrooms from Westlands to Industrial Area – HR green-lights hires, sales seals deals, ops stocks up, marketing blasts campaigns – and finance gets the memo after the fact. Result? Cash crunches, surprise tax hits and emergency loans at killer rates.

In this Seal Associates Insights article, we dive into why early finance integration isn’t optional – it’s your business’s lifeline. Let’s explore how to shift from blame to shared ownership for sustainable growth.

The All-Too-Common Story: Decisions Made, Finance Forgotten

I’ve seen this story play out far too many times with Kenyan businesses:

- HR approves salary increments and new hires

- Sales signs that big, complex, multi-month contract

- Operations imports a large consignment or expands inventory

- Marketing launches a nationwide campaign with heavy upfront spend

…and Finance is informed after the decisions are made.

Then reality arrives:

- Payroll cash crunch mid-month

- Supplier payments delayed → strained relationships & discounts lost

- VAT & PAYE obligations suddenly larger than expected

- Negative cash-flow surprises that force emergency borrowing at 16–22% interest

Suddenly everyone looks to Finance to “fix it” – but Finance cannot retroactively create cash that was never planned for.

Finance is often treated like invisible Wi-Fi:

Everyone expects it to always be there, blames it when the connection drops, yet rarely thinks about how the router should be positioned from the beginning.

The mirror cuts both ways though.

Sometimes Finance teams hide behind “compliance” and “policy” instead of becoming enablers – turning into roadblocks rather than co-pilots.

The real issue is rarely Finance itself.

It’s the absence of early integration and shared financial accountability.

The Game-Changer: Bringing Finance In Early

When Finance is brought in from the start, the entire picture changes:

- HR + Finance → salary & headcount planning tied to realistic cash-flow forecasts

- Sales + Finance → deal structuring that protects margins and collection timelines

- Operations + Finance → inventory & procurement decisions balanced against working capital cycles

- Marketing + Finance → campaign ROI targets and payback periods agreed upfront

Real-world impact we see with our SME clients:

- Early Finance involvement typically reduces emergency short-term borrowing by 30-60%

- Better cash-flow visibility cuts late supplier penalties and lost early-payment discounts

- Structured payment terms on large deals can improve operating cash-flow by 15-40% within 12 months

- Cross-functional financial literacy reduces surprise tax exposures and audit adjustments

Finance isn’t the department that says “No”.

It’s the partner that asks better questions so the answer can become “Yes, and here’s how we make it sustainable”.

The question every growing organization should ask is no longer:

“Does Finance deserve a seat at the table?”

It’s:

“Are we ready to move from blame to shared financial ownership?”

Why This Matters More Than Ever in Kenya’s 2026 Economy

In Nairobi’s cutthroat market – where fuel prices fluctuate, supply chains snag and KRA’s digital validations tighten (as we’ve covered before) – ignoring finance early is like driving without a dashboard.

SMEs make up 98% of businesses here, but cash flow kills more than competition. With interest rates at 16-22% for short-term loans, one unplanned decision can snowball into debt that derails growth for years.

We’ve helped clients in sectors from logistics in Mombasa to tech startups in Konza turn this around. One Nairobi retailer cut borrowing needs by 45% just by looping finance into procurement cycles – simple forecasts spotted overstock risks before they hit.

But it’s not just about avoidance; it’s empowerment. Shared ownership builds resilience – teams understand ROI, margins, and tax implications, turning “spend” into “invest.”

Practical Steps to Integrate Finance and Own Your Growth

As Seal Associates, we don’t just prepare financial statements – we help leadership teams integrate finance into strategy so growth doesn’t become a cash-flow crisis.

Here’s how to start:

- Audit Your Decision Processes – Map out key decisions (hires, deals, spends) and mandate finance input at ideation stage, not approval.

- Build Cross-Functional Tools – Use simple dashboards (e.g., Google Sheets or QuickBooks) for real-time forecasts – train teams on basics like “What if we add 5 hires?”

- Foster Financial Literacy – Run quarterly workshops: HR on payroll forecasting, sales on margin protection – turn “finance speak” into actionable insights.

- Set Shared KPIs – Tie bonuses to cash-flow metrics, not just sales targets -everyone owns the numbers.

- Partner with Pros – If your team’s stretched, outsource strategic finance reviews – we’ve helped SMEs spot 20-50% efficiency gains without cutting corners.

Let’s build businesses where Finance is the architect of sustainable progress, not the firefighter.

What’s one decision in your organization right now that would benefit from earlier Finance input?

Drop it in the comments – happy to share practical thoughts.

Wrapping Up: From Crisis to Co-Pilot – Make the Shift Today

In Nairobi’s endless hustle, sustainable growth isn’t about working harder – it’s about deciding smarter.

Integrate finance early, own the numbers together, and watch crises turn into opportunities. If your team’s facing a cash surprise or needs that strategic edge, reach out – we’re here to co-pilot.

Prepared by Seal Associates