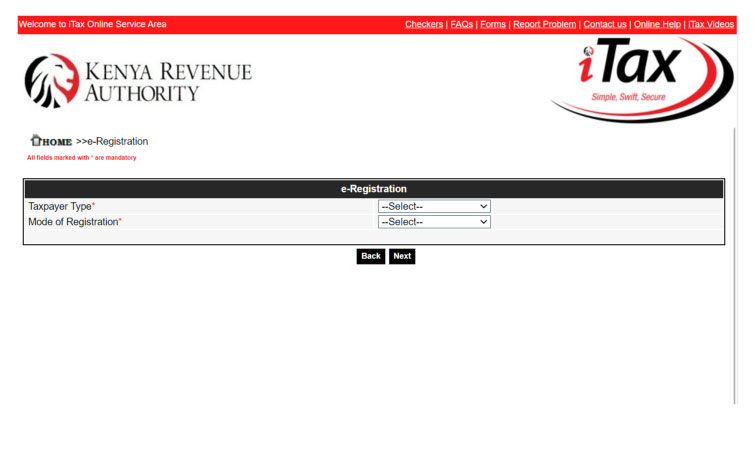

Some Transactions for Which A KRA PIN Is Required

Why you should not get a KRA PIN through the help of a non-tax expert

February 10, 2023

Withholding VAT in Kenya

February 28, 2023Some Transactions for Which A KRA PIN Is Required

- Registration of titles and stamping of instruments.

- Approval of development plans and payment of water deposits.

- Registration of motor vehicles, transfer of motor vehicles, and licensing of motor vehicles.

- Registration of business names.

- Registration of companies.

- Underwriting of insurance policies.

- Trade licensing.

- Importation of goods and customs clearing and forwarding.

- Payment of deposits for power connections.

- All contracts for the supply of goods and services to Government Ministries and public bodies.

- Opening accounts with financial institutions and investment banks.

- Registration and renewal of membership by professional bodies and other licensing agencies.

- Registration of mobile cellular pay bill and till numbers by telecommunication operators.

- Carrying out business over the internet or an electron c network including through a digital marketplace.

KRA PIN mistakes to avoid.

- Adding unnecessary obligations to their PIN like VAT, PAYE, MRI.

- Not understanding the due dates for filing their obligated tax returns

- Not filing returns for the first months or years that the business has not been trading.

- Including transactions in their return without understanding their net implication.

We do assist companies and individuals in KRA PIN Registration and advise on the best obligations that may be necessary to add to their PIN based on their nature of business. This helps have a valid tax plan from the start and helps reduce your tax burden. Contact us for assistance and guidance.