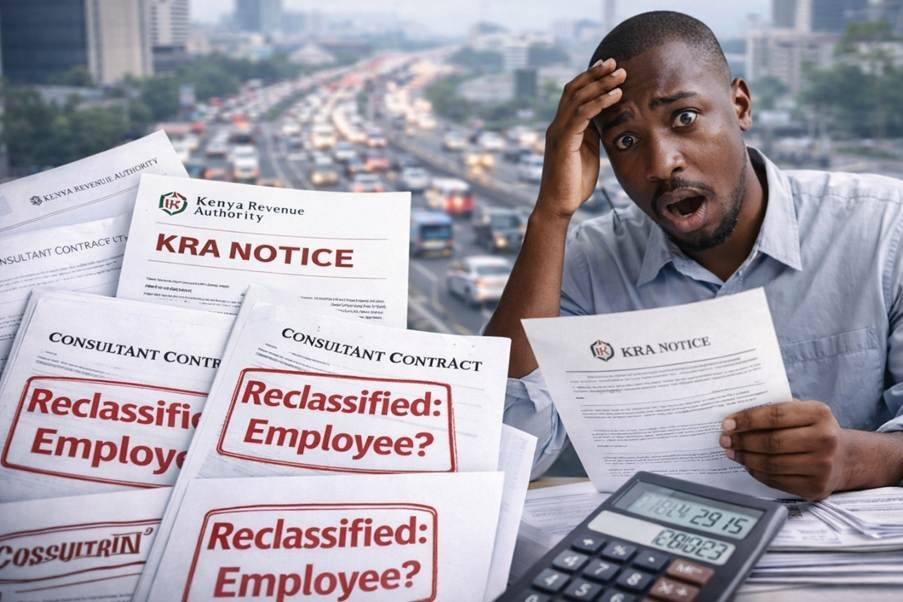

If you’re running a business that relies on consultants or freelancers to keep things lean, this might hit home harder than a matatu fare hike. We’ve all thought a solid consultancy agreement was bulletproof for tax purposes, low withholding, no NSSF headaches.

But KRA’s been reclassifying these setups as “employment in disguise,” slapping companies with massive PAYE backlogs, penalties and interest. Recent rulings show it’s not just big corps; SMEs are getting hit too.

In this Seal Associates Insights post, we unpack the risks, red flags and fixes so you can audit-proof your team before an assessment lands.

Seal Associates Insights: Misclassifying Consultants as Employees: How KRA Can Turn a Standard Contract into a Multi-Million Tax Exposure

Many businesses believe that signing a well-drafted consultancy agreement is enough to keep their tax obligations low and straightforward.

Reality has shown otherwise.

A growing number of Kenyan companies have received substantial tax assessments – sometimes exceeding KES 20 million – after the Kenya Revenue Authority reclassified individuals labeled as “consultants” as employees.

When this happens, PAYE should have been deducted at source, statutory contributions should have been remitted, and the tax position changes dramatically.

A Landmark Example That Businesses Should Study

In Qhala Limited v Commissioner of Domestic Taxes (2025), KRA challenged the status of 43 professionals who had been engaged under consultancy agreements.

The Authority’s position was clear: these individuals were employees in substance. The result was an additional tax demand of more than KES 20 million, covering underpaid PAYE, penalties and interest.

This decision is not an isolated incident – it reflects how KRA and the Tax Appeals Tribunal are currently assessing modern working relationships.

What Really Determines Employment vs Independent Contractor Status?

Kenyan courts and tribunals focus on the actual relationship, not the title given in the contract.

The most influential factors include:

- Level of control exercised over the person’s working hours, methods, location and priorities

- Degree of integration into the organisation’s structure, teams, systems and culture

- Whether there is mutual obligation to offer and accept work on an ongoing basis

- Who carries the economic risk (profit/loss, provision of tools, insurance, rectification of mistakes)

- Whether the engagement has a defined end or deliverable vs an indefinite continuation

- How payment is structured – milestone-based invoices vs regular fixed amounts resembling salary

When most of these elements point toward subordination, dependence and integration, the law treats the relationship as employment even if the contract uses the word “consultant” repeatedly.

Features That Triggered KRA Suspicion in Practice

In the Qhala matter (and in several similar disputes), the following characteristics raised red flags with the Authority:

- Invoices issued on nearly identical dates each month (mimicking payroll cycles)

- Routine reimbursement of travel, communication, accommodation and similar expenses

- Contractual provisions requiring confidentiality, non-compete obligations, exclusivity or full IP assignment to the company

- Consultants using company email addresses, attending internal strategy meetings, appearing on internal organograms or being presented externally as part of the team

Important clarification: No single one of these elements is decisive on its own. However, when several appear together – especially over long periods – they create a strong impression of employment.

Immediate Steps Every Business Should Consider

To reduce the risk of reclassification and large retrospective tax demands:

- Review all long-running consultancy relationships Pay special attention to engagements lasting over 12 months or involving regular on-site or daily involvement.

- Ensure behaviour matches the contract A clause stating “independent contractor” has almost no protective value if the day-to-day reality looks like an employment relationship.

- Restructure payment terms Shift from monthly fixed-sum invoices to payments clearly linked to specific deliverables, project phases or measurable outputs.

- Remove employment-like indicators wherever possible

- Stop issuing company email addresses or business cards

- Avoid requiring exclusivity unless genuinely necessary

- Do not routinely cover personal-style expenses

- Limit internal system access and meeting attendance to what is strictly required for the assignment

- Get expert classification advice before problems arise A professional review while the arrangement is still active is far less expensive than defending a KRA assessment years later.

Comparing the Tax and Compliance Consequences

| Worker Status | Tax deducted by the company | Other mandatory contributions | Main risk if wrongly classified |

| Employee | PAYE (progressive rates) | NSSF, SHIF, Housing Levy, Apprenticeship Levy (if applicable) | Full PAYE + late payment penalties + interest + possible criminal liability for non-deduction |

| Independent Consultant | 5% Withholding Tax | None (consultant handles own tax + VAT if applicable) | Retroactive PAYE liability + penalties + interest + potential VAT exposure |

A misclassification can easily multiply the original tax cost several times over once penalties and interest are applied.

Closing Message

The label “consultant” is no longer a reliable shield.

KRA and the tribunals focus on how people actually work, how they are managed, and how integrated they are into the business, not on what the contract declares.

In today’s environment of flexible teams, remote work, and long-term project engagements, many organisations unintentionally create employment relationships while continuing to treat them as consultancy for tax purposes.

The financial difference between being right and being wrong can now reach tens of millions of shillings.

The prudent approach is to act early: audit existing arrangements, align contracts with actual practice, remove employment-like features and seek specialist input proactively.

Because the next KRA notice may already be in preparation.

Final Thoughts: Safeguard Your Business Before It’s Too Late

In Nairobi’s competitive scene where every shilling counts, don’t let a contract slip-up drain your reserves. These cases show KRA’s not bluffing reclassification is real and costly.

Review your setups today, and if you need a second set of eyes, we’re here to help.

Prepared by Seal Associates Tax & Employment Compliance Team