Let me paint you a picture you already familiar to too many of us.

It’s December, you’re trying to clear suppliers, pay December salaries (with the bonus you promised when things were looking up in July), and then that iTax notification drops: “Outstanding tax liability – KSh 4.8 million principal + penalties + interest = pay immediately or we start enforcement.”

Your stomach literally drops. You know the money is owed. Business was slow in 2023 -2024, you fell behind on VAT and PAYE, and now the penalties have penalties. You’re not dodging tax – you just genuinely don’t have KSh 7 million lying around right now. You’ve been lying awake wondering whether to take that crazy chattel mortgage or sell the delivery van you worked so hard to buy.

My brother, my sister, breathe. As of 7th November 2025, KRA quietly rolled out something that actually feels like they were listening to us for once: the Automated Payment Plan (APP).

Yes, an actual instalment plan that’s built into iTax, automated, no begging at Times Tower, no long approval letters – just apply, system checks and if you qualify, you start paying in manageable chunks over up to six months.

I’ve spoken to three accountants this week and all of them said the same thing:

“This thing is real, and it’s a game-changer for SMEs that are alive but bleeding.”

Let me break it down like we’re having coffee at Java, no tax-jargon overload.

What exactly is this APP?

It’s an automated facility inside iTax that lets you spread your confirmed tax debt (principal + penalties + interest) over monthly instalments instead of one throat-choking lump sum.

The system itself validates your request in minutes or hours, not weeks. Once approved, you get a proper repayment schedule and you just pay via the usual methods (M-Pesa Paybill 222222, bank, etc.).

Maximum period? Six months right now. Some people are hoping KRA extends it to 12 months later, but even six months is huge when you’re staring at a KSh 6–10 million headache.

Who qualifies? Pretty straightforward:

- You must have a proper KRA PIN and your iTax profile must be updated (email, phone, bank details all correct – you know how iTax gets funny)

- The debt must be confirmed (meaning no active objection or court case running

- You must show you genuinely can’t pay everything at once (the system checks your recent payments and ledger – it knows if you’re trying to play smart)

- You propose a realistic schedule that clears everything within 6 months

If you tick those boxes, the system approves it automatically. No officer deciding your fate.

Why this feels different from the old waiver applications

Remember when we used to write those long letters begging for waivers or time to pay, and the officer would sit on it for three months then say no? This one is system-driven. Less human interference = less room for “chai” requests.

And crucially, while you’re faithfully paying your instalments, KRA doesn’t start agency notices, doesn’t freeze your accounts, doesn’t put you on the bad list that stops you tendering or getting loans. That alone is worth gold for most of us.

Real talk from businesses already using it

I know a guy in Eastlands who runs a hardware yard. He owed KSh 3.2 million in VAT from 2023 when construction slowed down. He applied last Thursday, got approved same day, now paying KSh 550,000 monthly for six months. He told me, “Bro, for the first time in two years I’m sleeping. I can plan.”

Another lady I know with a catering business in Westlands had KSh 2.1 million PAYE backlog because 2024 weddings dropped after the Finance Bill drama. She’s now paying KSh 360k monthly and has headspace to chase December bookings without panic.

Things to watch out for – because KRA is still KRA

- Miss even one instalment and the whole plan collapses. They cancel it and come for everything plus new penalties. Set a calendar reminder or standing order immediately.

- Interest keeps running on the outstanding balance. It’s not waived (yet – we’re pushing for that in next budget). But it’s way better than the previous situation where penalties were killing us.

- You still need to remain compliant going forward – file returns on time, pay current taxes, or they can cancel the plan.

- If your debt is in litigation or you have an active objection, sort that first.

How to apply right now (step-by-step because I know you’re busy)

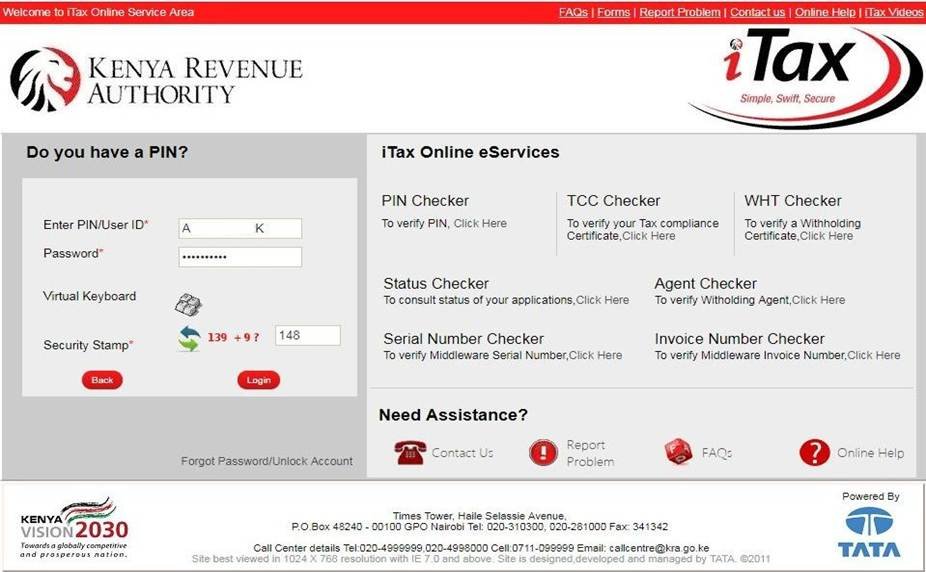

- Log into iTax

- Go to the Debt & Enforcement tab

- Look for “Apply for Automated Payment Plan” (it’s new, bright button)

- System shows your confirmed ledger balance

- Propose your monthly amount (must clear in 6 months max)

- Submit – approval is usually instant or within 24 hrs

- Start paying the generated slips

If you’re scared of doing it wrong, walk into any Huduma Centre or Seal Associates website – you’ll be helped.

Final word from one business owner to another

This APP won’t solve all our tax problems (we still need lower rates and penalty waivers), but for right now, in this tough economy where sales are unpredictable and banks are charging 22% interest, this is oxygen.

If you’ve been avoiding opening those KRA statements because you know what’s inside, today is the day you stop running. Log in, check your ledger and see if APP can give you breathing room.

Because the truth is, most of us want to pay tax – we just want to stay alive while doing it.

If you need help reviewing your ledger or applying, drop a comment or reach out via info@sealassociates.com.

Let’s keep our businesses running, let’s keep people employed and let’s take this small win that KRA has given us.

2 Responses

I wanted to thank you for this great read!! I absolutely enjoyed every bit of it. I have got you book-marked to look at new things you

This is amazing!! Tell me what you would like to understand more on Tax and we’ll make it happen.