INTRODUCTION OF KRA eTIMS

What you need to know to establish a business venture in Kenya

March 21, 2023

Tax Preparation in Kenya

March 22, 2023KRA eTIMs is a cloud-based software that makes it easy for VAT-registered businesses to connect their accounting system to KRA without the need to buy expensive ETR TIMS devices. The system went live on February 1, 2023.

The system can be accessed from the following devices by VAT taxpayers;

The system can be accessed from the following devices by VAT taxpayers;

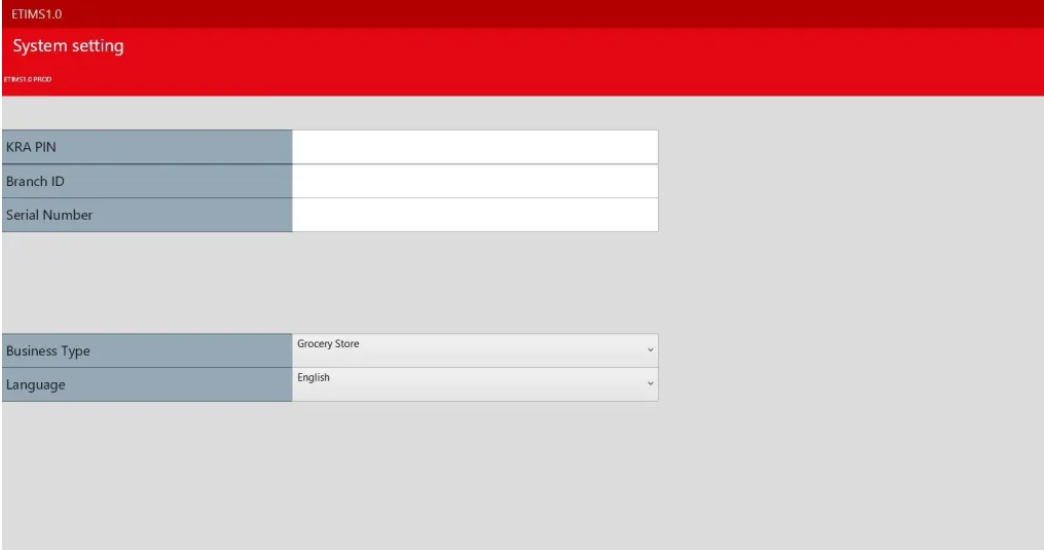

- eTIMS client: This is the desktop version

- Virtual Control Unit (VCU): This is targeted at VAT taxpayers with invoicing systems (ERPs) that can be integrated to VCU using 3rd party integrations

- Mobile App (android apk): This is targeted at small traders

- Online Portal: This is a web-based invoice portal.

Why eTIMS replaced TIMS

The TIMS ETR solution was expensive, complex, and unreliable which made it difficult for about 42% of VAT Taxpayers to be compliant (according to a statement issued by KRA board Chair Anthony Mwaura on January 23, 2023, there are VAT 106,600 taxpayers in Kenya and only 61,000 were registered with TIMS). Most of the 42% of the businesses that were not compliant were small businesses.

Main differences between TIMs and eTIMS

| TIMS | eTIMS |

| Device-driven: Businesses require an ETR machine integrated into their billing system for invoice transmission. | Software Driven: can be accessed through various devices. |

| Difficult to integrate with business accounting systems | easy to integrate with business accounting systems (via API) |

| Expensive to implement TIMS for small businesses | Affordable for all kinds of businesses |

How to register for eTIMS

To register for eTIMS

- Download the Akcnoldelement form from the KRA website (pdf)

- Print and fill out the form

- Tick the terms checkbox

- Scan and submit the form to KRA

You can download and install the paypoint apk or windows desktop app from the KRA website (under eTIMS).

For any questions related to eTIMS, email KRA at callcentre@kra.go.ke.