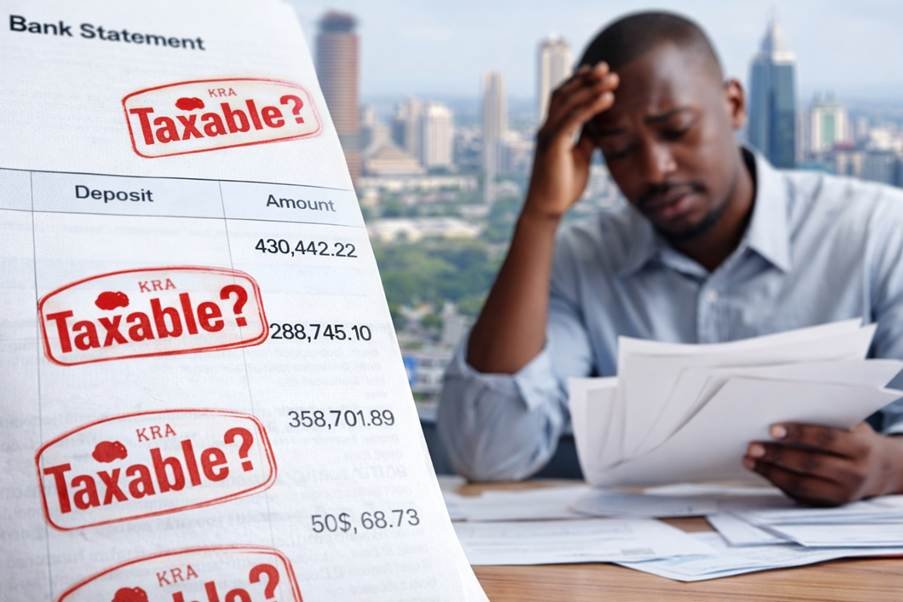

It’s February, 2026 and if you’ve ever felt that sinking dread during a KRA audit, wondering why your bank deposits are suddenly under the microscope, this one’s for you. The Kenya Revenue Authority’s practice of treating unexplained bank credits as taxable revenue isn’t new, but recent tribunal rulings are making it clearer than ever: The burden’s on you to prove otherwise.

In this Seal Associates Insights piece, we dive into the legal ins and outs, backed by fresh cases, so you can protect your business from unnecessary hits. Let’s break it down – no fluff, just actionable facts.

Seal Associates Insights: Under What Conditions Can the Kenya Revenue Authority Legitimately Classify Bank Credits as Taxable Revenue?

The Kenya Revenue Authority (KRA) frequently applies bank deposit scrutiny during audits and assessments. This technique presumes that money flowing into a business’s bank accounts represents taxable receipts unless the business clearly demonstrates otherwise.

Recent tribunal and court rulings consistently affirm this practice, emphasizing that the onus lies squarely on the taxpayer to disprove KRA’s position.

Legal Foundation and Burden Placement

Kenyan tax legislation places the responsibility of disproving an assessment on the person or entity being assessed. Specifically, Section 56 of the Tax Procedures Act requires taxpayers to furnish convincing proof when contesting KRA’s findings. Section 30 of the Tax Appeals Tribunal Act reinforces this requirement during appeals.

Once KRA raises an additional tax demand based on bank inflows, the taxpayer must produce reliable documentation to show that those credits stem from non-taxable origins – such as borrowed funds, equity contributions, internal group movements or returned amounts. Without solid substantiation, the Authority may lawfully regard the deposits as ordinary revenue subject to tax.

Situations Where KRA Can Justifiably Rely on Bank Inflows

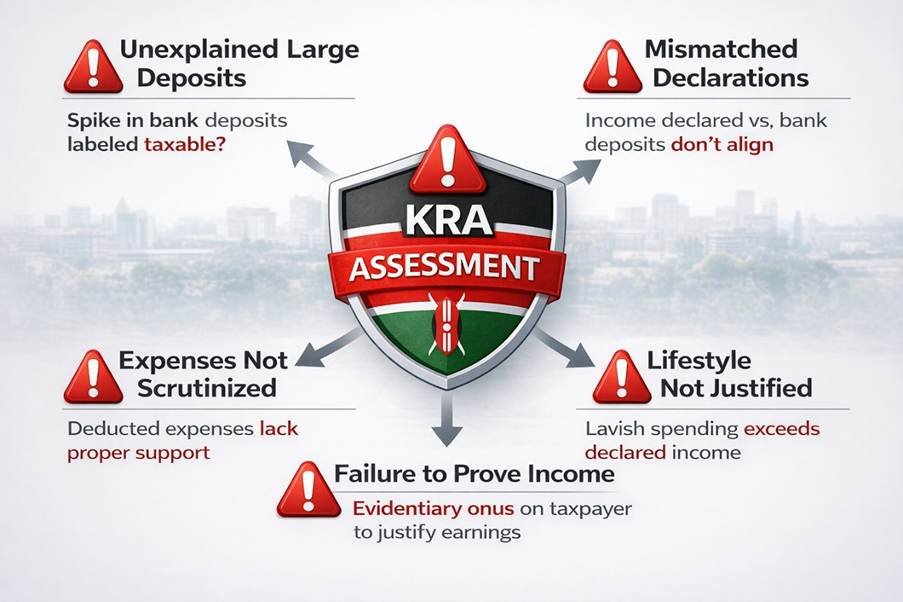

KRA’s approach gains legitimacy in several typical scenarios:

- Inability to discharge the evidentiary onus When a taxpayer cannot supply clear, verifiable records proving that credits arose from non-revenue sources, the Authority is entitled to treat them as taxable earnings.

- Deficient, inconsistent or missing accounting records If ledgers, financial reports or supporting documents fail to meet the standards set by the Income Tax Act and Companies Act, KRA may set them aside and base its assessment directly on patterns observed in bank statements.

- Absence of independent supporting proof Assertions that inflows represent loans, shareholder funds, inter-entity transactions, or reimbursements require backing from credible third-party or formal documentation, including:

- Formal loan contracts and clear repayment timetables

- Certified shareholder or board decisions plus current CR12 extracts

- Agreements, billing documents, or official correspondence confirming transfers or refunds Without such evidence, mere explanations are insufficient.

Notable Tribunal and Court Rulings Reinforcing This Principle

Kenyan judicial bodies have repeatedly endorsed KRA’s banking scrutiny method when taxpayers fall short on proof.

- Kirin Pipes Limited v Commissioner of Intelligence Strategic Operations Investigations and Enforcement (Tribunal Appeal E1116 of 2024) [2025] KETAT 259 (Judgment delivered 22 August 2025) During an audit covering financial years 2019–2022, KRA identified substantial bank credits and issued additional demands of approximately KES 34.3 million (income tax) and KES 22.7 million (VAT). The company contended that significant portions represented:

- Shareholder equity contributions beyond the originally stated share capital

- A substantial borrowing from a foreign entity

- Additional shareholder funding The Tribunal found that the company submitted inadequate linkage evidence – such as certified statements, board minutes, updated CR12 forms, or traceable capital flows. The claimed loan lacked defined terms, interest provisions or any demonstrated repayments during the period under review. Citing the statutory burden under Section 56 TPA and Section 30 TATA, the Tribunal ruled the explanations unsubstantiated. The appeal was dismissed, and KRA’s assessments were upheld.

Other Illustrative Decisions

- Gemini Properties Limited v Commissioner (Income Tax Appeal E056 of 2022) [2024] KEHC 908 (19 January 2024) The High Court confirmed KRA’s entitlement to treat unexplained credits as taxable when the taxpayer could not produce tenancy contracts, receipts or reliable proof distinguishing loans, tenant security, or internal transfers.

- Roniam Construction Limited v Commissioner (Tax Appeal E019 of 2024) [2024] KETAT 1669 (21 November 2024) The Tribunal rejected claims that certain deposits constituted borrowings or equity injections due to insufficient substantiation, sustaining the additional tax liability.

- Hamron Logistics Limited v Commissioner (Tax Appeal E972 of 2023) [2024] KETAT 1612 (22 November 2024) Despite extensions granted, the company failed to deliver adequate records explaining credits allegedly arising from loans, equity, returned cheques, or internal adjustments. The appeal failed on the basis of unmet evidentiary requirements.

Key Takeaway

KRA’s bank deposit examination remains a legally accepted audit tool in Kenya. Tribunals uphold it precisely because unexplained credits are viewed as prima facie receipts of taxable income unless convincingly rebutted.

Practical Steps to Safeguard Your Position

To minimize the risk of deposits being reclassified as taxable:

- Maintain comprehensive, organized records from the outset: Certified bank statements, formal equity resolutions, loan documentation with repayment evidence, and transaction correspondence.

- Respond promptly during the objection stage with all relevant materials – courts have ruled that late submission may render evidence inadmissible.

- Work with qualified tax advisors to compile robust supporting files and prepare well-reasoned objections. Professional support significantly improves the likelihood of meeting the required standard of proof.

By prioritizing strong documentation and timely compliance, businesses can better protect themselves against adverse recharacterization of bank inflows.

Wrapping Up: Don’t Let Unexplained Deposits Derail Your Business

Sandra, in Nairobi’s fast-paced business scene, KRA audits can feel like a storm out of nowhere but with solid proof in hand, you can weather it. These rulings show that preparation is everything: Build your records now, and you’ll stand strong if scrutiny comes. If you’re facing an audit or just want to audit-proof your books, reach out knowledge is your best defense.

Prepared by Seal Associates Tax Team