Tax Advisory and Tax Consultancy Services in Kenya

In the intricate landscape of modern business, tax advice and strategic planning play pivotal roles in ensuring optimal financial performance. At Seal Associates, our mission as tax consultants is to meticulously evaluate and manage the tax burden for our clients, keeping them in compliance with the ever-evolving local and international tax laws.

Our dedicated tax division focuses on providing advisory, agency, and tax compliance services across various sectors, recognizing that taxation constitutes a major business cost.

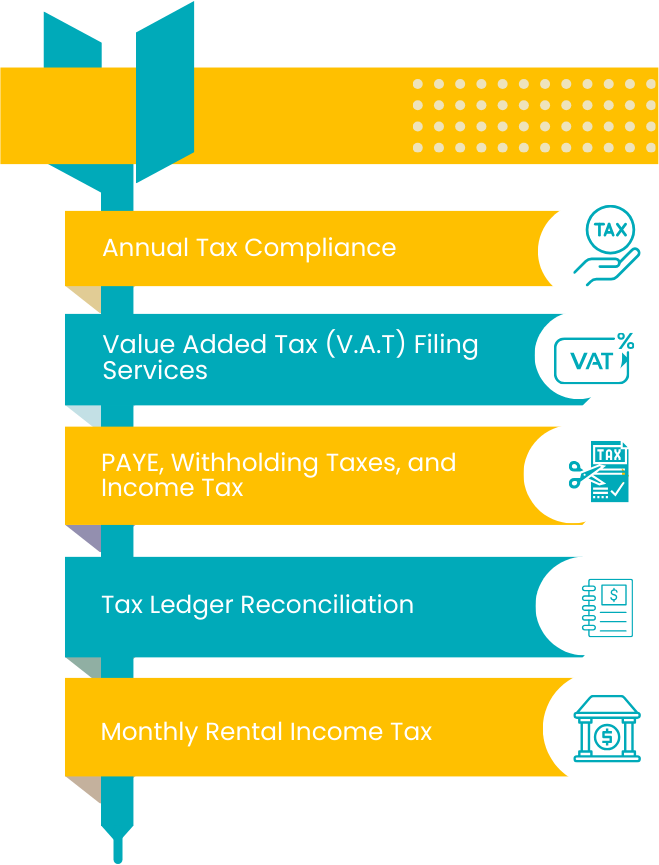

We provide comprehensive assistance in the following areas:

Annual Tax Compliance

Drawing on our extensive experience, we handle the tax affairs of both corporate entities and individuals across diverse industries. Our services include reviewing accounting systems for tax compliance, computing year-end corporate taxes, conducting due diligence on tax status, and timely submission of statutory tax returns. We also offer unlimited telephone support, ensuring that our clients receive guidance on various tax matters arising from unique transactions.

Value Added Tax (V.A.T) Filing Services

Our expertise extends to Value Added Tax (V.A.T) Filing Services, ensuring accurate and timely submissions to facilitate smooth business operations. As the best tax consultants in Kenya, we specialize in providing unparalleled VAT-related services, ensuring compliance with VAT Withholding taxes.

PAYE, Withholding Taxes, and Income Tax

Navigating the intricacies of PAYE, Withholding taxes, and Income tax, our tax consultants in Kenya are well-versed in handling diverse aspects of taxation. From computing and advising on year-end corporate taxes payable to reviewing annual Pay as You Earn (PAYE) returns, we provide comprehensive solutions to meet your specific needs

Tax Ledger Reconciliation

Our services extend to tax ledger reconciliation, ensuring accuracy and transparency in your financial records. We meticulously review and reconcile tax-related transactions, providing you with a clear and concise overview of your tax position.

Monthly Rental Income Tax

Recognizing the significance of managing monthly tax obligations, our tax experts at Seal Associates specialize in assisting clients with monthly rental income tax. We understand the unique challenges associated with residential rental income, and our value lies in helping clients effectively manage and remit their monthly tax obligations to the Kenya Revenue Authority (KRA) promptly.

Tax Health Check

Our methodical approach to tax health checks involves a thorough review of financial transactions, identifying areas of tax risks, opportunities yet to be utilized, and measures available for tax planning purposes. By adopting this approach, we assist organizations in minimizing tax liabilities, framing effective tax plans, and maximizing potential opportunities.

Tax Planning and Corporate Restructuring

Effective tax advice and planning are crucial for businesses to adapt to changing environments, mitigate risks, and gain a competitive edge. Seal Associates helps organizations integrate tax planning into their operations, enabling them to reorganize effectively and enhance tax benefits. As businesses evolve globally, our services aim to align tax planning with strategic business decisions, maximizing growth opportunities and driving operational efficiencies.

Tax Objections and Appeals

In instances of disputes, our tax consultants at Seal Associates are well-equipped to handle tax objections and tax appeals. We provide expert guidance and representation to ensure fair and just outcomes in challenging tax situations.